Current Bitcoin price:

€100.000,00

BTC to EUR: 1 Bitcoin is currently converted into 1 Bitcoin.

For what amount do you want to buy Bitcoin (BTC)?

quick deposit

easy, secure & 24/7

transparent fees

Your benefits with 21bitcoin

21bitcoin is your leading provider for the purchase and secure storage of Bitcoin in Austria 🇦🇹 and Germany 🇩🇪.

Best in class service for low fees

We don't like complicated fees and want to make it as simple and transparent as possible for you to buy and sell Bitcoin.

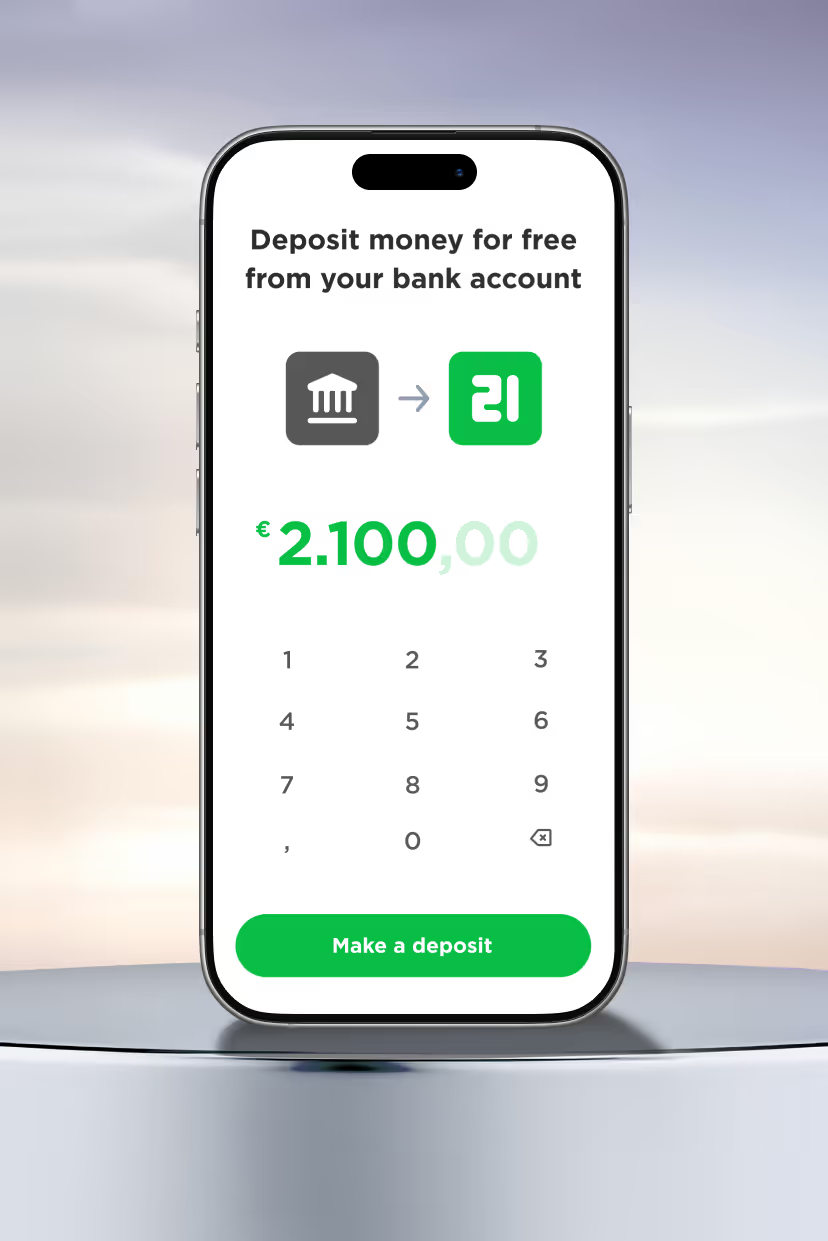

Deposit money instantly

Invest immediately and without delays. No deposit fee, no hidden costs.

Buy Bitcoin

21bitcoin is your easiest way to buy bitcoin instantly - with excellent fees.

Sell Bitcoin

In case you really want to sell your Bitcoin, we provide you with the tools to do it.

Would you like to buy Bitcoin, but still have questions?

Bitcoin is a digital currency that is fully decentralized — without central control by banks or governments. The technology behind it is the blockchain, a transparent and secure digital ledger that records every Bitcoin transaction in a verifiable manner. New Bitcoin units are created through mining, a process in which computers solve complex tasks to secure the blockchain and verify transactions.

As a digital currency, Bitcoin is limited to a maximum of 21 million units. This reduces the risk of inflation and makes it a form of digital gold. The decentralized network ensures that neither a single actor nor an institution can gain control over Bitcoin. The blockchain guarantees that all transactions are public, tamper-proof, and immutable. In mining, participating miners play a central role: They validate and store transactions in the blockchain, while at the same time new Bitcoin are generated.

In summary, Bitcoin is a digital currency that is unique thanks to its decentralized, blockchain-based architecture. Mining not only keeps Bitcoin functional but also secure and independent.

With 21bitcoin, you can buy Bitcoin quickly and securely. Simply register, make a deposit via SEPA Instant transfer – and with just four clicks you can buy Bitcoin. Savings plans, limit orders, and automatic wallet transfers are also available. This way, you get Bitcoin instantly and flexibly, around the clock.

You don’t need to buy a whole Bitcoin – smaller amounts are possible. The smallest unit is called a Satoshi: 1 Bitcoin equals 100 million Satoshis. This gives you easy access, even if the price of a full Bitcoin seems high. Buying Satoshis works just like buying a whole Bitcoin: You simply choose the amount in Euros, and you’ll receive the corresponding amount of Satoshis in your wallet. This way, you can invest flexibly and build your Bitcoin wealth step by step.

With 21bitcoin, you can start buying Bitcoin from just €10 – a tiny fraction of a Bitcoin (called a Satoshi). This makes accessing Bitcoin especially easy and flexible for beginners – ideal for regular investments or a savings plan.

➜ Learn more about savings plans here.

The Bitcoin price is formed on exchanges through supply and demand. Buyers and sellers place bids – when supply and demand match, the current price is determined. That’s how the market works: if many are buying, the price goes up; if selling pressure increases, the price goes down.

In addition, sentiment, market confidence, news, and regulations also influence the price. Large market participants (“whales”) can move the price significantly in the short term because their trades impact supply.

Overall, the Bitcoin price is the result of a complex interaction between supply and demand, price formation on exchanges, and a range of market factors.

➜ Find more details on this topic in our blog.

At 21bitcoin you can deposit money into your account via SEPA and SEPA Instant (real-time transfer) – free of charge. This means you can buy Bitcoin without deposit fees using either a standard bank transfer or instant transfer (SEPA Instant). Both payment options give you easy access to real Bitcoin.

➜ Find more information here.

No, you don’t need your own wallet to buy Bitcoin. You can hold Bitcoin directly in your 21bitcoin app. For more control, we also offer Auto Wallet Transfers – allowing you to conveniently move your Bitcoin to your private wallet and manage it yourself whenever you’re ready.

At 21bitcoin, you pay no deposit fee – 0%. The buying fee starts at 0.79% – transparent and fair. Selling, wallet withdrawals, and transactions also follow clear, fair fee structures – with no hidden costs.

➜ Find more details on fees here.

21bitcoin offers a standard purchase limit of €100,000 per purchase with no limit on the frequency of purchases, and a sales limit of €100,000 per sale, also with no limit on the frequency of sales. For Bitcoin withdrawals, the limit is 2.1 BTC per transfer. Cash can be withdrawn via SEPA transfer with no limit.

➜ Further information can be found here.

If you want to buy Bitcoin via instant deposit, the main advantage is speed. The direct transfer ensures that your funds are credited immediately, so your balance is available right away. Especially in times of high volatility, it’s crucial to be able to buy Bitcoin without delay.

Besides speed, security is equally important. An instant deposit should only be made with trusted providers who process deposits reliably and protect customer funds. With our partner bank VR Bank Bayern Mitte, you can be sure that your money is credited directly and securely after deposit.

The advantage is clear: with an instant deposit you can react flexibly to market movements without waiting days for the credit. The combination of fast access, secure processing, and the ability to own Bitcoin instantly makes this method of purchase particularly attractive.

Yes – 21bitcoin offers flexible savings plans that let you buy Bitcoin automatically on a daily, weekly, or monthly basis. This way, you benefit from the cost-average effect, reduce timing risks, and grow your Bitcoin holdings in the long term – conveniently, securely, and cost-efficiently.

After your deposit (via SEPA or instant transfer), you can buy Bitcoin instantly, 24/7. Savings plans and limit orders are executed automatically without delay. Your purchased Bitcoin are available to you immediately – even on weekends.

Every exchange worldwide has its own Bitcoin price because it has its own buyers and sellers who set their own prices. The Bitcoin price is therefore determined by supply and demand on each individual marketplace.

As a result, there is no single official Bitcoin price, but rather many market prices that are constantly adjusting to each other, similar to currency exchange rates.

Since supply and demand are constantly changing, the Bitcoin price can fluctuate within seconds.

To ensure that you can still buy safely and reliably, we guarantee the price displayed for 20 seconds – even if the market moves during this time.

To make this price guarantee possible, the displayed price includes a small safety margin (price range). This price range is already transparently included in the price on the confirmation screen in the preview.

The price range serves to cushion short-term market fluctuations and offer you a stable, guaranteed price – without the risk of the price suddenly changing in those crucial seconds.

The proper storage of Bitcoin determines the security of your investment. One of the most important methods is using an offline wallet. There are different types: software wallets, hardware wallets, and paper wallets. Hardware wallets are considered especially secure because private keys are stored offline and cannot be stolen by hackers from the internet.

Another key factor is the management of private keys. Only those who control these keys have full control over their Bitcoin. That’s why the saying goes: “Not your keys, not your coins.” Wallet backups should also be stored securely – ideally in multiple protected locations.

The choice of platform also plays a role. If you store your Bitcoin on an exchange, you rely on its security. For larger amounts, it is recommended to use your own wallet, since no third party has access.

If you’re just getting started buying Bitcoin or want to familiarize yourself with wallets first, you can safely store your Bitcoin in your 21bitcoin account.

Conclusion: A secure wallet, carefully protected private keys, and the right level of personal responsibility ensure that your Bitcoin remain safe in the long term. With consistent security practices, you can store your BTC reliably and worry-free.

The tax treatment depends on your place of residence. For Austrian residents, 21bitcoin automatically handles the taxes. For everyone else, we provide account statements in the app and direct integration with tax tools.

➜ You can find information here for Austria and here for Germany.

Bitcoin began as a groundbreaking idea: in 2008, Satoshi Nakamoto published the whitepaper “Bitcoin: A Peer-to-Peer Electronic Cash System.” With it, Nakamoto introduced the concept of a blockchain-based payment technology that is decentralized, secure, and transparent. In early 2009, Satoshi launched the first version of the system with the so-called “Genesis Block” – Bitcoin was born.

The Genesis event marks the very origin of Bitcoin – the Genesis Block was mined and the first mining reward was issued. Even back then, it was clear: Bitcoin is more than just a technology; it represents an entirely new financial system with its own currency: BTC.

➜ Find more information on this topic in our blog.

Bitcoin is more than just a digital innovation – it’s a scarce and independent form of money. With a fixed limit of 21 million coins, no government or central bank can create more. This scarcity protects against inflation and makes Bitcoin valuable in the long run.

Historically, those who regularly bought Bitcoin have seen strong returns. Limited supply combined with rising demand is what gives Bitcoin its reputation as digital gold.

Security also plays a key role. Thanks to its decentralized blockchain, the network is stable and resistant to manipulation. Bitcoin cannot be frozen or confiscated, making it a reliable asset.

Conclusion: Buying real Bitcoin means choosing a limited, secure, and independent store of value with long-term growth potential.

➜ Learn more in our blog.

Many see Bitcoin as a hedge against inflation. The reason: the supply of Bitcoin is limited to 21 million – this absolute scarcity protects it from arbitrary expansion. Unlike government-issued money, which can be printed without limit, Bitcoin remains strictly capped. Because of these properties, Bitcoin is often referred to as modern “digital gold.” Its function as a store of value makes it especially attractive in times of rising inflation. For those looking to protect their wealth, Bitcoin can serve as a complement to traditional assets.

Yes, you can use Bitcoin for payments. More and more merchants worldwide accept Bitcoin for goods and services. Every payment is processed as a transaction on the blockchain and can be transparently verified. For everyday use, the Lightning Network offers additional advantages: it enables nearly instant transactions with minimal fees, making even small payments easy.Conclusion: Whether directly via the blockchain or with Lightning – Bitcoin is a modern payment method that offers merchants and users fast and secure transactions.

➜ Find more information here.

A Bitcoin transaction takes around ten minutes on average — that's how long it takes the network to find a block. Each confirmation further secures the transaction. In practice, merchants often wait for multiple confirmations before finally accepting payments.

However, the actual time may vary. When the network is busy, the wait time is extended, while low usage makes the transaction faster. If you want instant payments, you can use the Lightning Network, which processes transactions in seconds.

In short, the duration of a Bitcoin transaction depends on the network and confirmation — around ten minutes on average, almost instantly with Lightning.

Bitcoin is neither fully anonymous nor completely transparent – it is pseudonymous. Every transaction is recorded on the blockchain and can be viewed transparently. Instead of real names, addresses appear that work like account numbers. If someone knows the owner of an address, they can trace the related transactions. That’s why Bitcoin is only seemingly anonymous. In reality, it combines transparency with a certain degree of privacy. Conclusion: Bitcoin transactions are public and transparent, but participants use Bitcoin addresses instead of real names. This makes Bitcoin pseudonymous, not fully anonymous.

➜ Find more information on this topic in our blog.

The blockchain is at the heart of Bitcoin. It stores all transactions in a chronological chain, which is checked by thousands of computers worldwide. Thanks to the decentralized structure, no one can manipulate the data. Each Bitcoin transfer is confirmed by miners and stored in a block.

As a result, the blockchain makes Bitcoin forgery-proof: Once registered, transactions can no longer be changed. The decentralized system ensures transparency and trust without the need for banks.

In short: The blockchain makes Bitcoin a secure, decentralized network that reliably processes millions of transactions worldwide.

➜ You can find even more information on this topic in our blog

Bitcoin is considered extremely secure due to its robust blockchain, which is distributed worldwide and has never been completely hacked. The decentralized network makes manipulation almost impossible: The blockchain is stored redundantly, and any change would be immediately noticeable. As a result, Bitcoin enjoys a high level of security.

Nevertheless, it is not the blockchain that is weak, but possible weak points lie in stock exchanges or wallets. Anyone who keeps their Bitcoin in insecure wallets or on dubious platforms risks hacks or loss. But the security of the Bitcoin blockchain itself remains unwavering — a strong, trustworthy network.

21bitcoin is audited and regulated by the Austrian Financial Market Authority (FMA), works with the German bank VR Bayern Mitte and the renowned custodian BitGo. In addition, 21bitcoin offers transparent fees, insured custody, 24/7 support from German-speaking staff, and trustworthy reviews – providing a solid foundation for buying Bitcoin securely.

Buying Bitcoin comes with opportunities but also risks. One of the biggest mistakes is underestimating volatility. Bitcoin’s price fluctuates in the short term, which can lead to panic selling. Investors should be aware of the risks and maintain a long-term investment horizon.

Another critical point is storage security. Many investors neglect their wallet and end up losing access to their coins. Private keys must never be shared – and keeping a secure wallet backup is essential. This is the only way to ensure Bitcoin remain safe in the long term.

Equally important is choosing the right trading platform. Relying on untrustworthy providers puts your money at risk. Focus on security, transparency, and a regulated environment to buy Bitcoin reliably.

So, avoid hasty decisions: do your research, consider volatility, take care of your wallet and security. This way, you reduce the biggest risks and protect your Bitcoin investment in the long run.

➜ With 21bitcoin, you can buy Bitcoin securely.

Bitcoin can be bought directly (physically), or invested via ETFs or ETPs. Spot ETFs/ETPs buy and keep real Bitcoin physically in the background. In contrast, synthetic products rely on derivatives to represent Bitcoin performance without storage.

Physical spot ETPs or ETFs give investors access to Bitcoin without having to manage custody themselves. Other products use derivatives, such as futures, to replicate Bitcoin's price action. If you want real Bitcoin, choose spot ETFs/ETPs or buy directly — without derivatives, directly real Bitcoin.

Bitcoin is the oldest cryptocurrency and is primarily used as a store of value and as a means of payment. In contrast, other cryptocurrencies like Ethereum enable complex smart contracts that allow intelligent transactions without intermediaries. Bitcoin’s blockchain is the most widely distributed worldwide and offers the highest level of security.

From a technical perspective, Bitcoin is designed purely as a blockchain currency, while Ethereum, for example, goes beyond that by serving as a platform for decentralized applications. Bitcoin’s security comes from its robust, decentralized blockchain, which is broadly replicated. Other networks are often smaller and therefore tend to be less resistant to attacks – making their security weaker.

In addition, Bitcoin is accepted and traded worldwide – its blockchain is proven and reliable.

Bitcoin and stablecoins pursue different goals. Bitcoin is a scarce asset whose price depends on supply and demand – which is why it is highly volatile. A stablecoin, on the other hand, is pegged to a fiat currency like the US dollar, keeping its price stable. The biggest difference: while Bitcoin serves as a store of value and investment, stablecoins are mainly a tool for fast payments or trading pairs on exchanges. The lack of volatility makes stablecoins practical for everyday use but less attractive as a long-term investment. Conclusion: Bitcoin offers scarcity and store of value, stablecoins offer price stability. Both have their role – the key differences lie in volatility and use case.